Community Loan Fund – Investors

Why invest with the Community Loan Fund of the Capital Region?

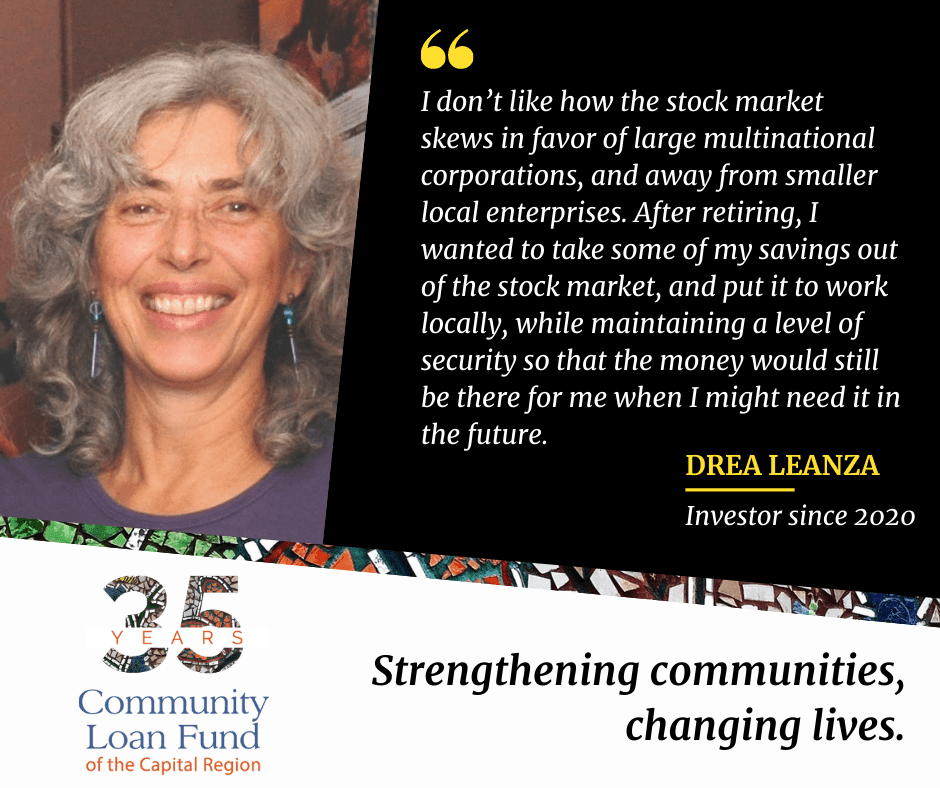

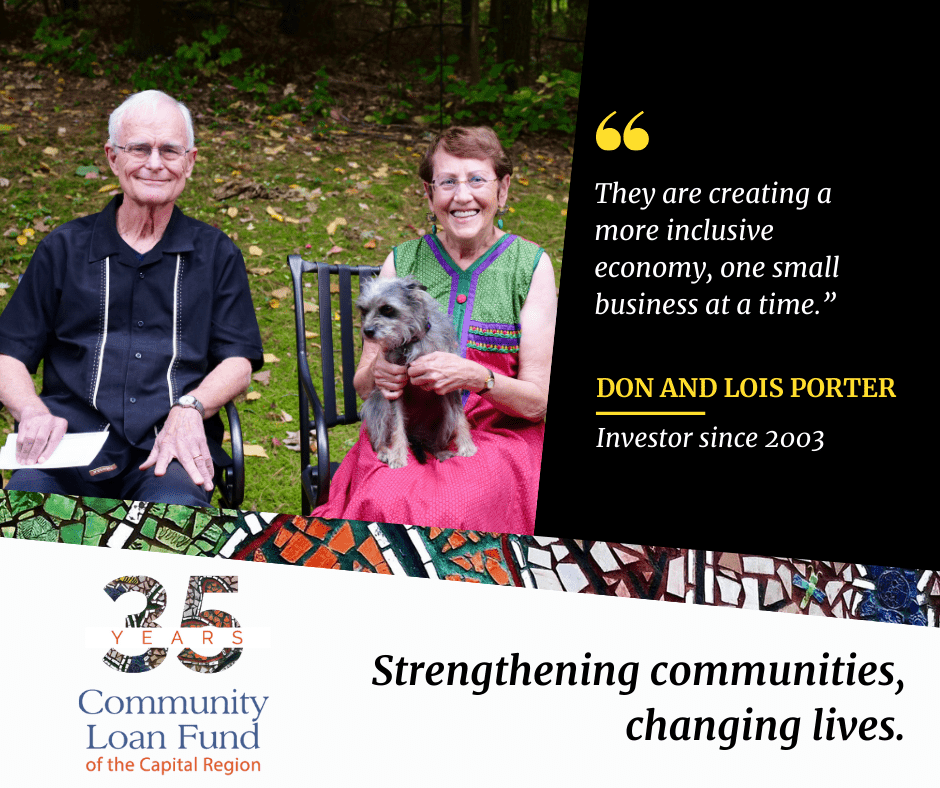

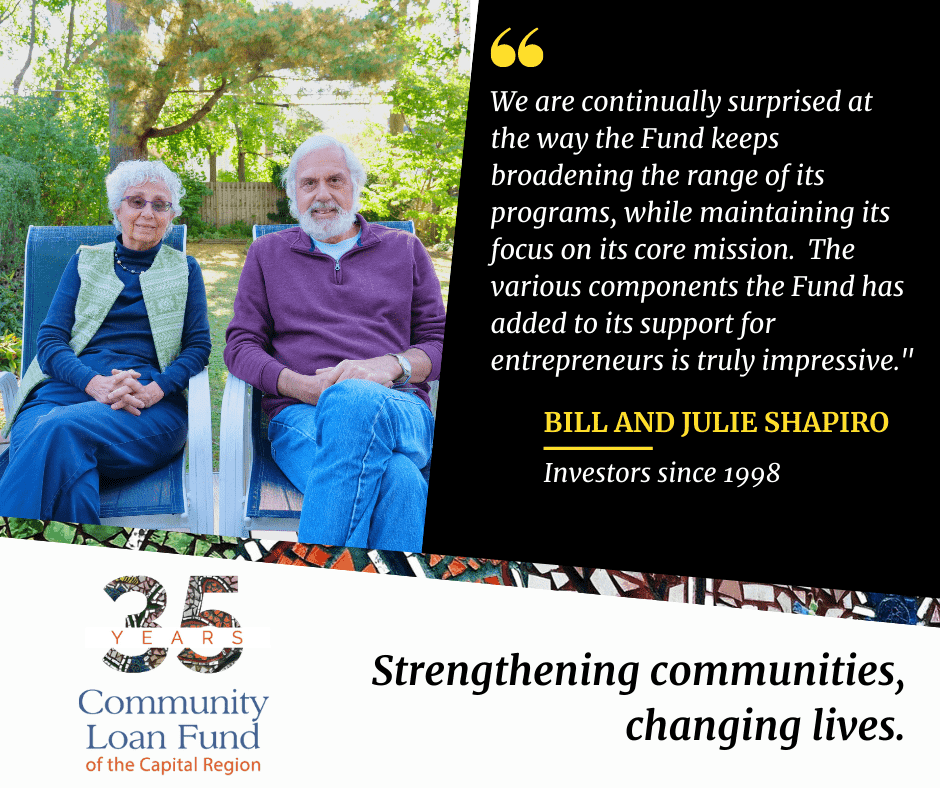

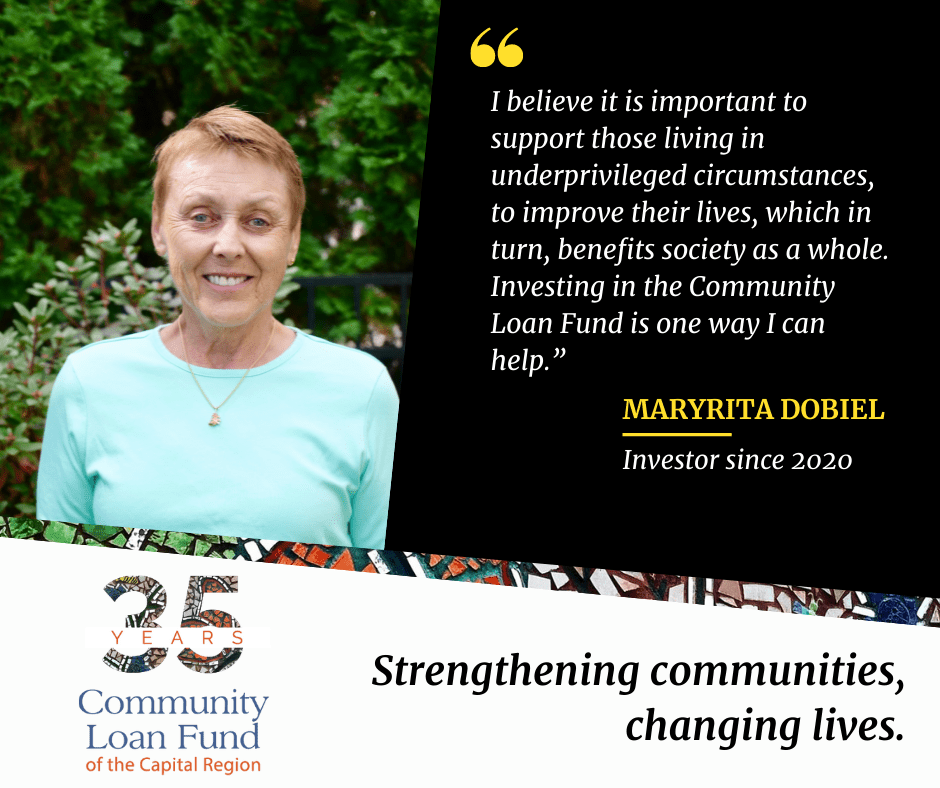

When you invest money with us, we pool that money with other investments to build new businesses, develop new community projects, and support the valuable work of local non-profits. Since 1985, the Community Loan Fund has been accepting investments from socially conscious individuals and organizations who want to support healthy and equitable communities.

When you invest money with the Community Loan Fund of the Capital Region, we use that money to make low-interest loans to support local economic development.

We lend money to:

- Women and BIPOC-owned businesses in your neighborhood

- Nonprofits providing essential community services

- Community development projects that make our neighborhoods healthy, safe places to live

What are the results?

With more than 800 donors, investors and volunteers, the Community Loan Fund has:

- Originated more than 1,000 loans to nonprofits, small business owners, and homeowners totaling more than $76 million.

- Financed more than 1,746 affordable housing units

- Created or retained more than 4,025 jobs

- Leveraged more than $265 million in local community and economic development

- Provided training and technical assistance to thousands of small business owners and nonprofit leaders.

How do I get started?

- Investors include individuals, family trusts, banks, credit unions, local companies, and faith-based institutions. See our Impact Report for a complete list of investors.

- First, decide on the amount you want to invest – $1,000 minimum. (For smaller investments, consider joining our Emerging Investors Network.)

- Then, decide on how many years you want to invest this amount. The longer the term, the higher the interest rate you can earn.

- Investments can range from $1,000 to $1,000,000, with terms of 1 to 20 years, and interest rates up to 1.75%. Larger investments are individually priced.

- The Community Loan Fund is certified by the U.S. Department of Treasury as a Community Development Financial Institution (CDFI). We have a 100% repayment rate to all investors.

- Meet with one of our investment specialists to complete the necessary paperwork and make your investment. Start an investment with financial as well as social dividends.

Set up your appointment today. Call (518) 436-8586 or complete this brief form to set up an appointment with our team.